Is India becoming a #cashlesseconomy?

The government wants India to be a cashless economy: the move towards a cashless economy is a move towards greater accountability towards the flow of money, reduction in black economy and bringing more people into the banking system.

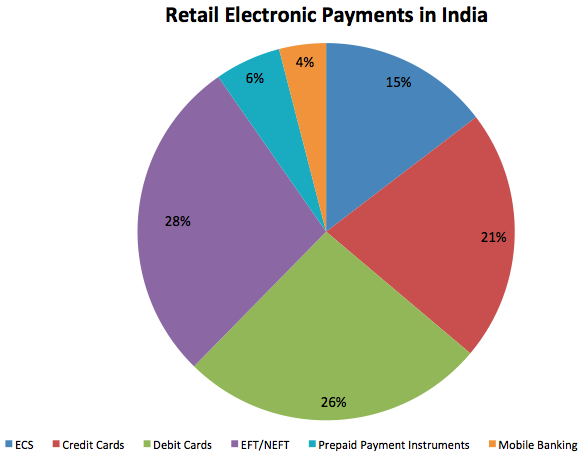

The retail electronic payment space in India is dominated by inter-bank money transfer modes like NEFT or National Electronic Fund transfer, Electronic clearing system, and credit and debit cards. Newer modes of payment like prepaid wallets along with mobile banking are becoming popular.

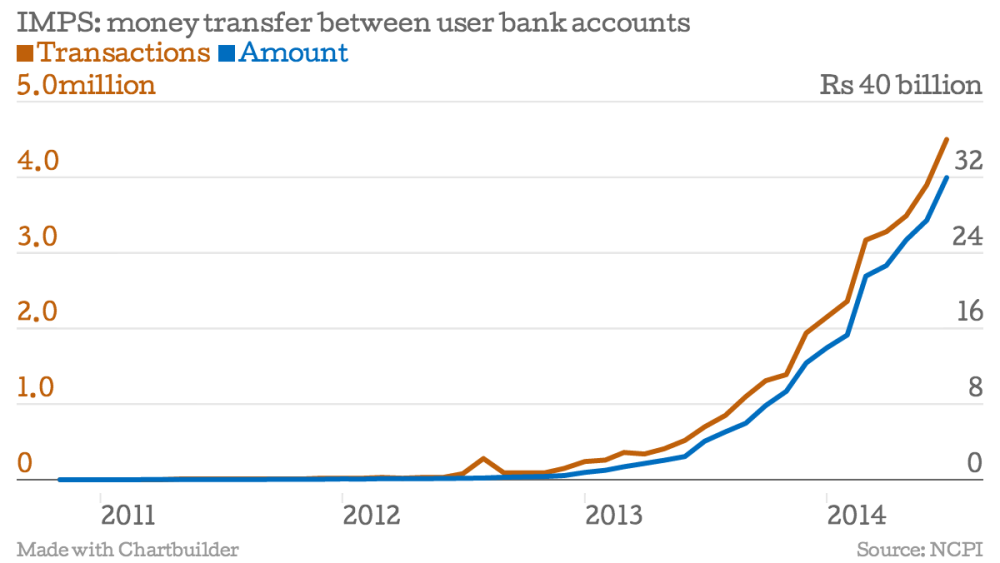

59% of Indian households are banked while the mobile tele-density is around 74%. The fastest growth is coming from mobile payments. The interbank mobile payments service has increased from just 860 transactions in its first month in November 2010 to 4.4 million transactions in August 2014.

In November 2010, six banks, including ICICI Bank, India’s largest private sector bank, and the State Bank of India, India’s largest public sector bank, launched the Interbank Mobile Payments Service, allowing customers to transfer money between bank accounts, on the basis of mobile money ID’s.

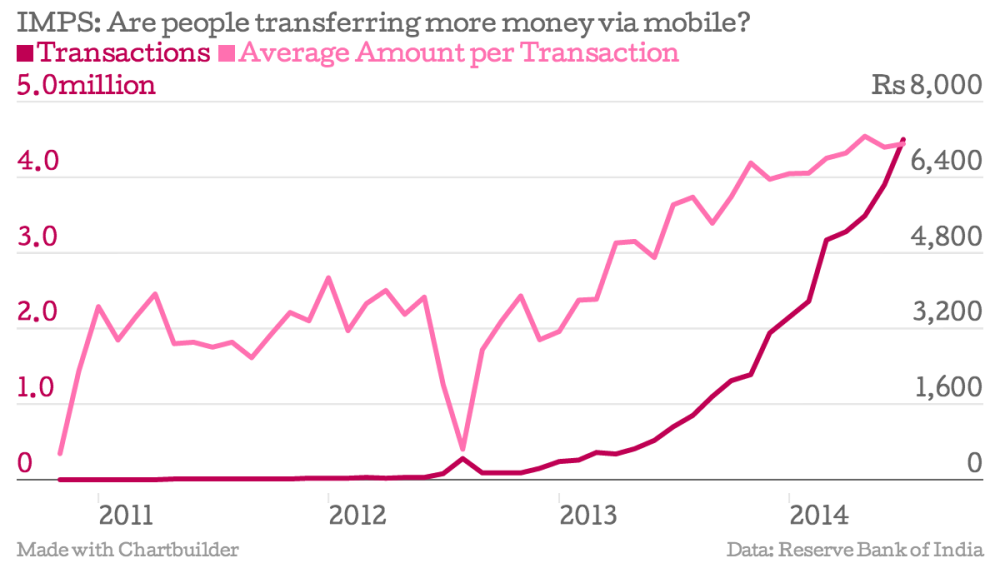

From just 2182 transactions in January 2011, the number of IMPS transactions have increased 987 times to 2,153,883 in January 2014. The amount transacted has grown 1745 times, from Rs 7.9 million to Rs 4.6 billion.

Typically, as the number of active ID’s and the number of transactions increase, the average amount transacted declines. In case of mobile money transfers, the average amount per transaction has almost doubled (1.76 times) to Rs 6476 from Rs 3661 per transaction.

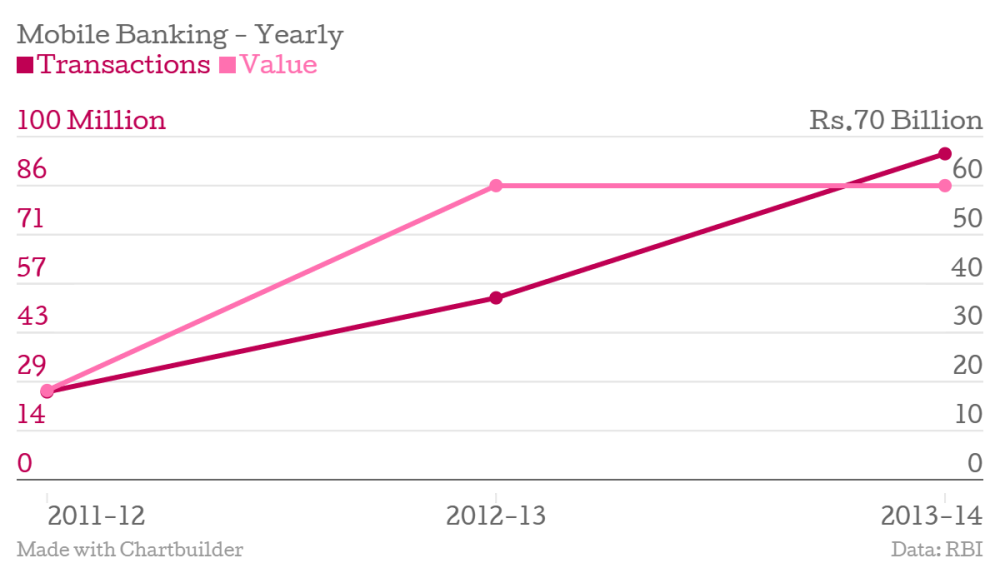

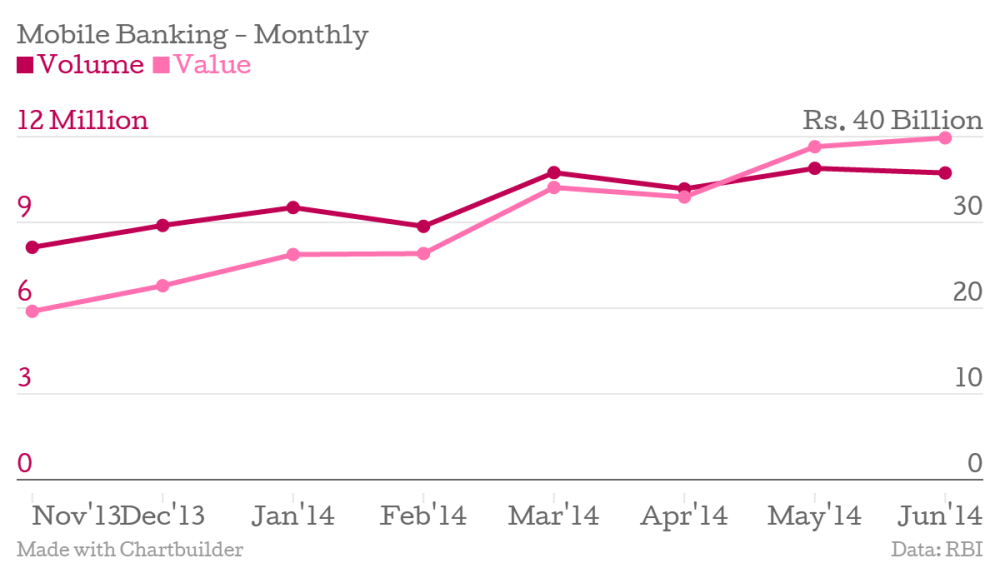

Mobile banking transactions

The concept of mobile banking was virtually non-existent five years ago. But in just 3 years, number of transactions using mobile banking has increased 4 times to 95 million while the amount transacted has increased three times to 60 billion rupees.

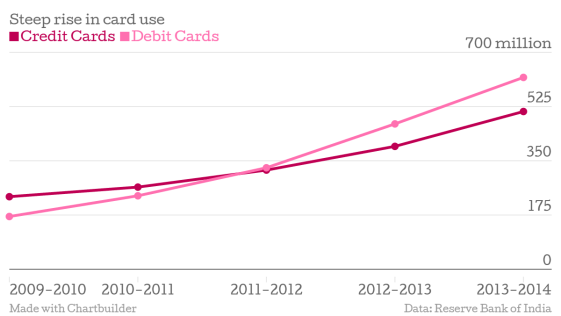

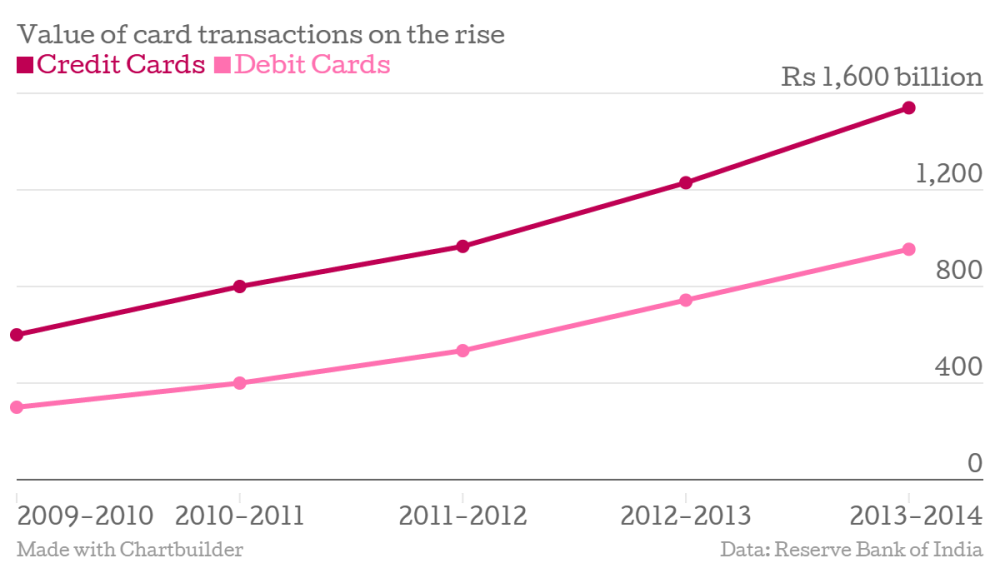

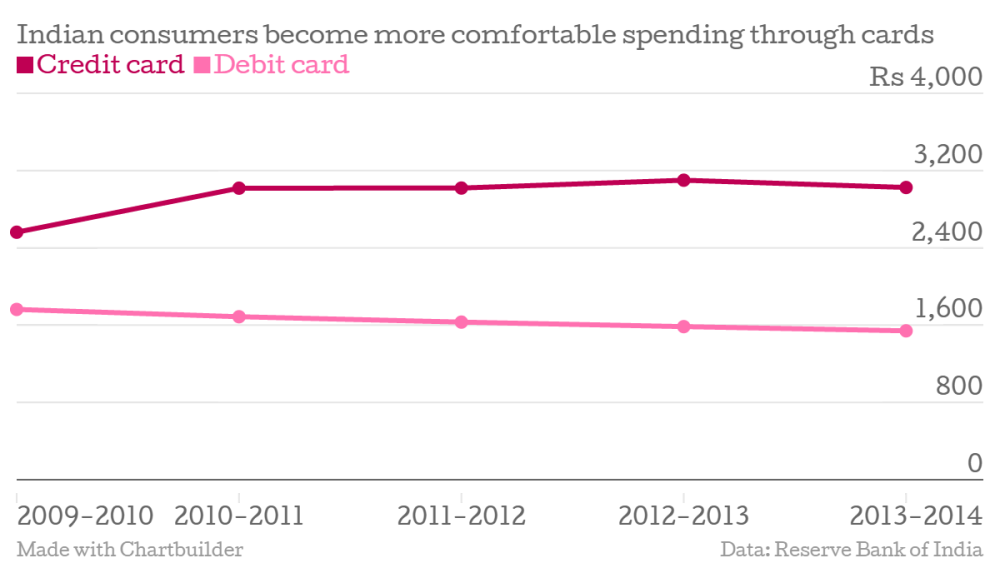

Credit and Debit Cards

The value per credit card transaction has also increased gradually over the last few years, as consumers become more comfortable using these cards. The increased security features introduced by the central bank like chips in cards and compulsory personal identification number or PIN have also contributed to the increased card usage.

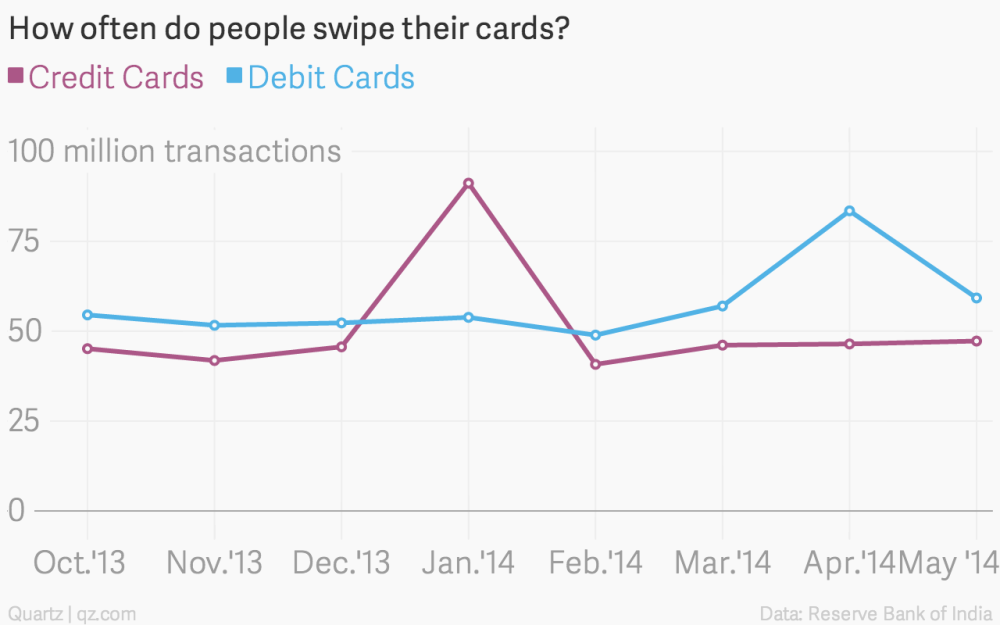

In fact, people have gradually started using cards more often to transact. Number of transactions using credit cards jumped by around 100% in January 2014. This is partly because of the heavy discounts offered by brands during the month indicating that more and more people are using cards while shopping. The increased frequency with which Indians are using cards bodes well for online retailers who have used the more expensive mechanism of cash on delivery to attract customers.

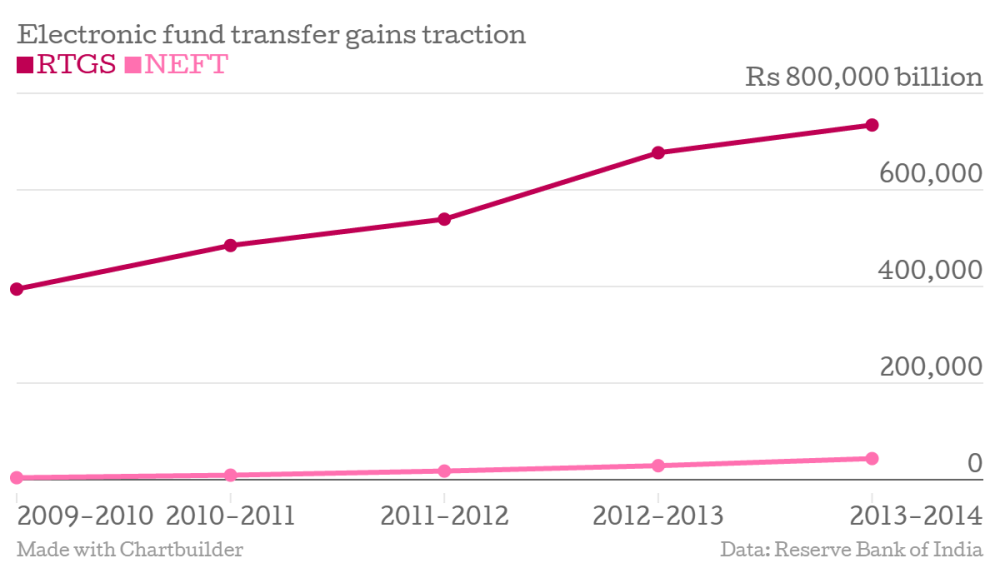

Electronic Fund Transfers

The RTGS system and the NEFT system for inter bank fund transfers has also played an important role in gradually phasing out paper based transactions. Paper based transactions have come down to 34.6% in 2013-14 of all non-cash transactions from 43.4% in the year ago period.

While there is growth in the electronic payment systems, going ahead, security concerns versus ease of doing banking will be the major dilemma facing the central bank when it frees up the retail payment space and allows the introduction of new payment instruments.